Year-over-Year (YoY): Formula and Excel Calculator

What Is Year-Over-Year (YOY)?

Year-over-year (YOY)—sometimes named as year-on-year—is a oftentimes used monetary comparison for gazing 2 or a lot of measurable events on associate annualized basis. perceptive YOY performance permits for gauging if a company’s financial performance is improving, static, or worsening. For example, you’ll scan in financial reports that a selected business reportable its revenues exaggerated for the third quarter, on a YOY basis, for the last 3 years.

KEY TAKEAWAYS

• Year-over-year (YOY) could be a methodology of evaluating two or more measured events to check the results at one amount with those of a comparable amount on associate annualized basis.

• YOY comparisons are a preferred and effective thanks to value the monetary performance of a corporation.

• Investors seeking to measure a company’s financial performance use YOY reporting.

Also Read: WHAT IS DIGITAL SELLING MARKETING (DIGITAL MARKETING)?

Understanding YOY

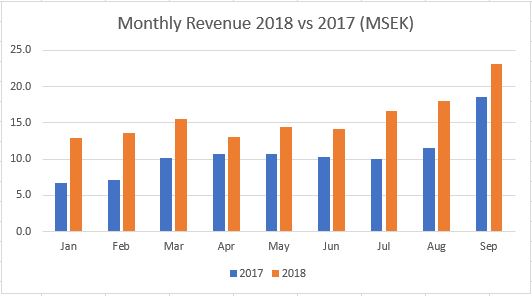

YOY comparisons are a popular and effective way to evaluate the financial performance of a company and therefore the performance of investments. Any measurable event that repeats annually are often compared on a YOY basis. Common YOY comparisons embrace annual, quarterly, and monthly performance.

edges of YOY

YOY measurements facilitate the cross comparison of sets of data. For a company’s first-quarter revenue mistreatment YOY knowledge, a {financial associatealyst|securities analyst|analyst} or an capitalist will compare years of first-quarter revenue data and quickly ascertain whether or not a company’s revenue is increasing or decreasing.

For example, within the half-moon of 2021, the Coca-Cola corporation reportable a 5% increase in internet revenues over the primary quarter of the previous year. By scrutiny a similar months in numerous years, it’s doable to draw correct comparisons despite the seasonal nature of shopper behavior.3 This YOY comparison is additionally valuable for investment portfolios. Investors prefer to examine YOY performance to envision however performance changes across time.

Reasoning Behind YOY

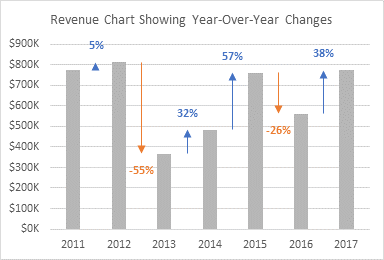

YOY comparisons are common once analyzing a company’s performance as a result of they assist mitigate seasonality, an element which will influence most businesses. Sales, profits, and alternative monetary metrics modification throughout different periods of the year because most lines of business have a season and a coffee demand season.

For example, retailers have a peak demand season during the vacation searching season, that falls within the fourth quarter of the year. To properly quantify a company’s performance, it is sensible to check revenue and profits YOY.

It’s necessary to compare the fourth-quarter performance in one year to the fourth-quarter performance in alternative years. If associate capitalist appearance at a retailer’s ends up in the fourth quarter versus the previous third quarter, it’d seem that a corporation is undergoing unprecedented growth once it’s seasonality that’s influencing the distinction within the results. Similarly, in a very comparison of the fourth quarter with the subsequent initial quarter, there might appear a dramatic decline, when this might even be a results of seasonality.

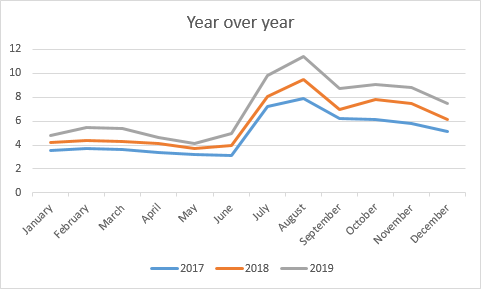

YOY additionally differs from the term sequential, that measures one quarter or month to the previous one and permits investors to see linear growth. For instance, the amount of cell phones a school company sold-out within the fourth quarter compared with the third quarter or the number of seats associate airline stuffed in January compared with December.

Real-World Example

in a very 2019 data system report, food manufacturer Company free mixed results for the fourth quarter of 2018, revealing that its YOY earnings continued to decline, even once sales exaggerated following company acquisitions. Kellogg foreseen that adjusted earnings would drop in an extra 5% to 7% in 2019 because it continued to speculate in alternate channels and pack formats.4

The company additionally discovered plans to reorganize its North America associated Asia-Pacific segments, removing many divisions from the previous and reorganizing the latter into food manufacturer Asia, Middle East, and Africa. Despite decreasing YOY earnings, the company’s solid presence and responsiveness to shopper consumption trends meant that Kellogg’s overall outlook remained favorable.4

what’s YOY Used For?

YOY is employed to form comparisons between only once amount and another that’s one year earlier. this permits for an annualized comparison, say between third-quarter earnings this year vs. third-quarter earnings the year before. it’s ordinarily accustomed compare a company’s growth in profits or revenue, and it may also be accustomed describe yearly modifications in an economy’s cash supply, gross domestic product (GDP), and alternative economic measurements.

however Is YOY Calculated?

YOY calculations are simple and frequently expressed in share terms. this may involve taking this year’s worth and dividing it by the previous year’s value and subtracting one: (this year) ÷ (last year) – 1.

What’s the distinction Between YOY and YTD?

YOY appearance at a 12-month change. Year to this point (YTD) looks at a change relative to the start of the year (usually Jan. 1).

What If i’m curious about Comparisons for fewer Than a Year?

you’ll} cypher month-over-month or quarter-over-quarter (Q/Q) in a lot of a similar method as YOY. Indeed, you can opt for any time-frame you desire.

the basics of finance and Accounting

no matter your learning style, understanding corporate finance and accounting is straightforward once you can make a choice from 183,000 on-line video courses. With Udemy, you’ll be able to learn accounting nomenclature and the way to organize monetary statements and analyze business transactions. What’s more, every course has new additions revealed each month and comes with a 30-day money-back guarantee.